by Liz Lizama

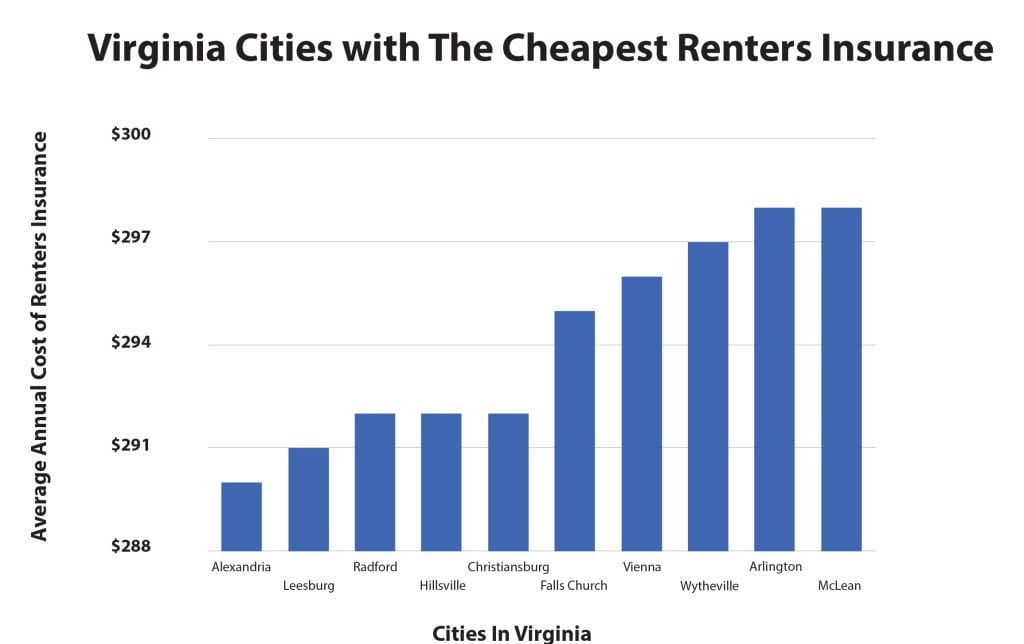

According to a recent ValuePenguin report, Falls Church is the sixth cheapest city for renters insurance in Virginia.

At a mean annual rate of $295, Falls Church averages are just $5 higher than Alexandria, the city with the cheapest average renters insurance rate, and $4 higher than Leesburg, the city with the second cheapest average renters insurance.

Vienna, Arlington and McLean also made the top 10, ranking seventh, ninth and tenth, respectively.

The study averaged quotes from five major insurance providers for at least $25,000 in personal property coverage and $100,000 in liability coverage for a 1,000-square-foot residence.

The average annual premium for Virginia amounted to $312, bringing Falls Church 5.6 percent below the state average.

What factors impact these low rates?

“The short answer is a lot of things,” said Michael Thrasher, research analyst for ValuePenguin.

“When it comes to renters issurance, people automatically jump to crime rates. Companies take this into account when pricing policies. They are looking at claims history, and some cities have more claims than others.”

Beyond crime statistics, Thrasher said insurance companies also consider other variables like the number of fire trucks the local fire department owns or whether staff are full-time or volunteer.

“Insurance companies use online coding tools with specific questions like if the property is within 1,000 feet of a fire hydrant,” said Thrasher. “If you live 1,001 feet, you may get a different rate.

Tony Iannarelli of Liberty Mutual said newer buildings built with fire resistant material and equipped with sprinkler systems also mitigate the risks of damaging an entire property.

“The difference between renting an apartment complex versus a single family home – almost every time you will get a cheaper rate with the apartment complex because like I said they are built with fire resistant materials, sprinkler systems, alarm systems,” said Iannarelli.

“There are other security measures there that are going to help prevent any risks that will affect the policyholders themselves.”

Iannarelli said a lot of it weighs heavily on credit now as well. As the News-Press reported earlier this year, F.C. residents hold the least amount of credit card debt in the state of Virginia, a likely driver to lower insurance rates for some individuals.

But weather is the most significant factor that impacts rates, according to Thrasher.

“Weather is unpredictable and can be very damaging,” he said. “When you look at weather historically for an area, it makes sense.”

Hurricanes, for example, are not as likely to rip through Falls Church as that would in a coastal city like Norfolk, the fourth most expensive city in Virginia for renters insurance.

While factors like weather are uncontrollable, Iannarelli said the policyholder’s personal property is what really dictates the rate.

“With my company, you can go as low as $15,000 in personal property, if you choose to go higher, you will see a big difference in price,” he said.

“I have some people here that are just working in this area that have minimal property here and just need liability because they’re covered by their homeowner’s insurance,” Iannarelli said of clients that own property elsewhere.

“There’s a misconception that their personal property is only covered when it’s on the premises. It’s covered anywhere – you still have personal property coverage even if it’s not in your home. A lot of people don’t know that.”